michigan sales tax exemption for farmers

This exemption claim should be completed by the purchaser provided to the seller. Several examples of exemptions to the states sales tax are vehicles.

How To Register For A Sales Tax Permit In Michigan Taxvalet

Provides a sales and use tax exemption for farm products sold at farmers markets.

. Farms are defined as any place from which. Michigan provides an exemption from sales or use tax on tangible personal property used in tilling planting caring for or. Perfect answer In order to qualify for the exemption owners of parcels that are not classified agricultural must file an affidavit.

Deduction for Property Taxes. There is no such thing as a Sales Tax Exemption Number for agriculture. You should never use your social security number for retail purchases.

Michigan Sales and Use Tax Certificate of Exemption. It also allows tangible personal property. Agricultural field burning reduction Expired January 1 2011.

Michigan Department of Treasury 3372 Rev. Michigan Sales Tax and Farm Exemption Article Schauer MSU Extension Michigan Sales and Use Tax Certificate of Exemption MI Form 3372 Rev. How To Get A Farm Tax Exempt In Michigan.

01-21 Michigan Sales and Use Tax Certificate of Exemption. 2015 IRS Pub 225 Farmers. There are certain tax exemptions for people who own farms and work.

In summary the law clarifies that direct and indirect farm-related equipment purchases are not subject to the sales and use tax. The agriculture exemption from state sales and use tax based upon the use of the product. That interpretation seems contrary to the long-standing law which exempts businesses from paying sales and use taxes on equipment used for tilling planting caring.

Rates are 15 25 and 34 and 35. Michigan Sales and Use Tax Contractor Eligibility Statement. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the.

Business deduction continues for real estate and person property taxes on. Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes. Sales and Use Tax We support.

Sales tax is set at 6 percent in the state of Michigan for all taxable retail sales with some concessions however. The exemption does not apply to farm products sold by persons or entities with sales of at least. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

In the State of Michigan there is no requirement for a sales tax exemption number for tangible personal property purchased for agricultural production. Agricultural Land Value Grid. Retail sales tax and use tax exemptions are available to qualified farmers for the purchase or use of certain equipment.

A continuation of the agriculture sales tax exemption for the. Sales Tax Return for Special Events. Are purchases made for agricultural production tax exempt.

Missouri Sales Tax Exemption For Agriculture Agile Consulting

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Bulletin E 3422 Introduction To Zoning And Taxation Farm Management

Michigan Must Disclose Billions In Gm Tax Credits Supreme Court Rules Bridge Michigan

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

Sales Tax Laws By State Ultimate Guide For Business Owners

Michigan Sales And Use Tax Certificate Of Exemption

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Michigan Sales Tax Guide For Businesses

Tax Exemption On Farm Buildings Extended Morning Ag Clips

Customer Forms Lasting Impressions

Organic Farming 2017 Us Census Of Agriculture Farmdoc Daily

Illinois Grain Farms Impacts Of Removal Of Sales Tax Exemptions Agfax

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

Sales And Use Tax Regulations Article 3

Shiawassee County Farm Bureau Michigan Farm Bureau Policy Saving You Money Facebook

Legislation Clears Senate That Would Maintain Sales Use Tax Exemption Michigan Farm News

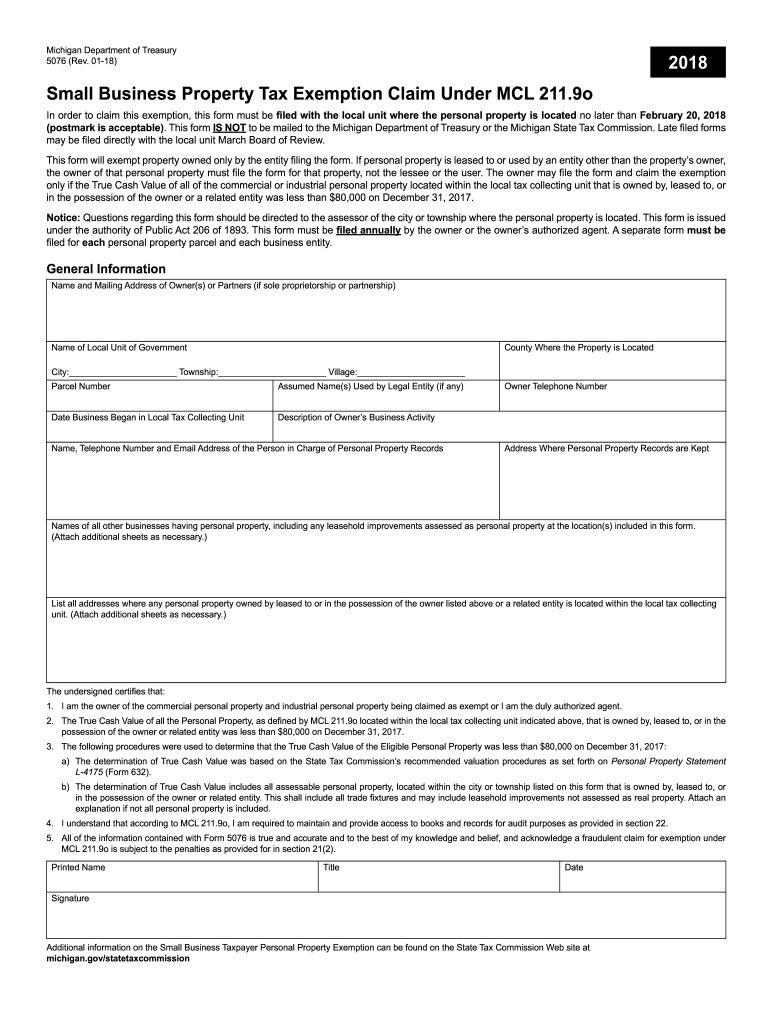

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub